How Does Refinancing A Vehicle Loan Work

The short answer is yes it can, but how much depends on where your credit currently stands along with how you go about the refinance. This involves changing the name of the company that is listed on your car’s title, which is a document that details proof of official ownership.

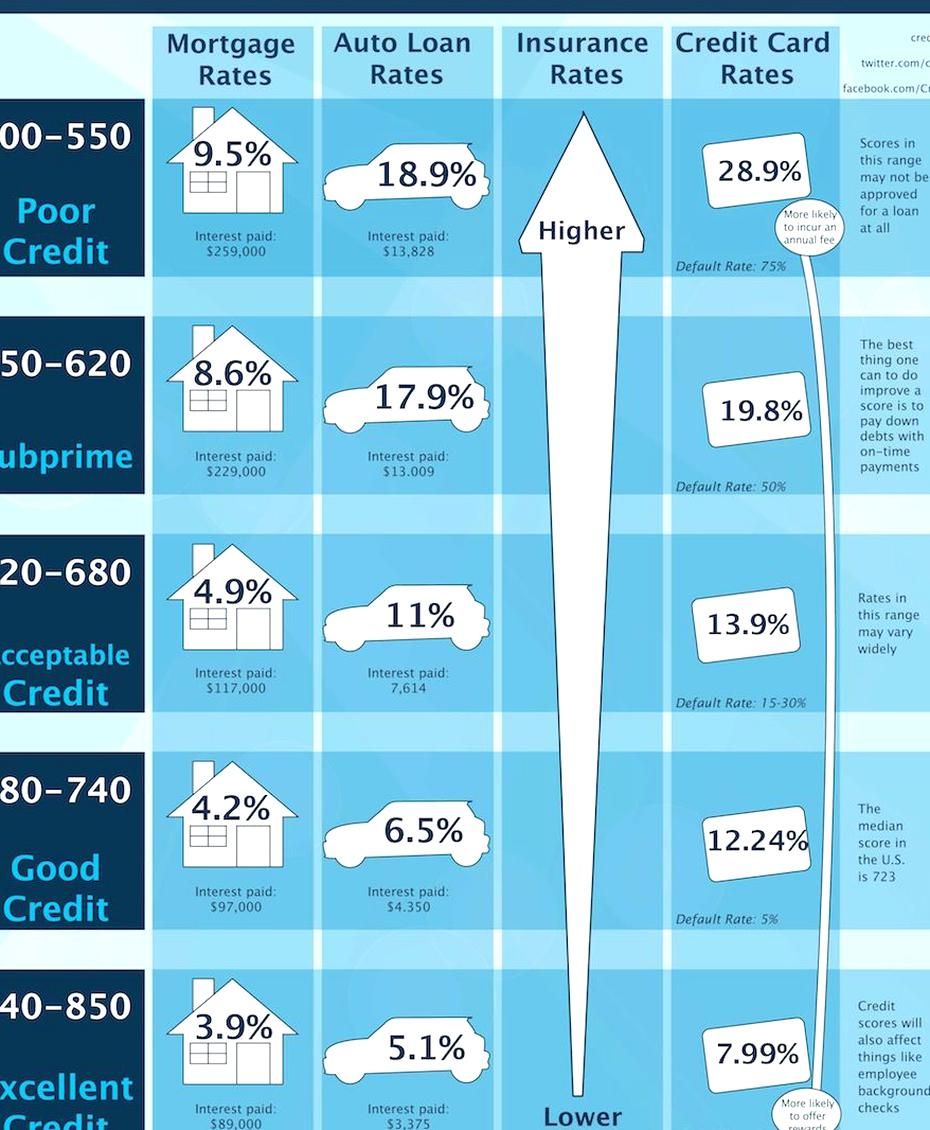

average loan interest rate in 2020 Credit card rates

The goal of refinancing a car loan is to lower your payment each month.

How does refinancing a vehicle loan work. Refinancing your auto loan is typically easier than buying a new/used vehicle. The primary reason is to lower your monthly car payments. How does refinancing a car loan work?

In that case, your new vehicle loan pays off the previous one, leaving you with a new loan agreement. There needs to be a benefit, whether that’s a more favorable loan term or a lower interest rate. In practice, auto refinancing is the process of paying off your current car loan with a new one, usually from a new lender.

This means that if you decide to purchase a house, for example, and your monthly expenses increase as a result, you can reduce the amount you pay on your vehicle loan to cover the shortfall. There are various possible outcomes and, in many cases, it’s about saving money or otherwise finding a more affordable loan. You look for a new auto loan company that offers lower rates than your current one.

When you refinance a car, you replace your current car loan with a new loan of different terms. You will still owe less than what the vehicle is worth and have $1,500 of new money available to spend after the new loan pays off your previous $5,000 balance. One option would be to refinance your vehicle for $6,500.

Refinancing your auto loan is a simple process. Most of these loans are secured by a car and paid off in fixed monthly payments over a predetermined period of time — usually a few years. It can also give you an opportunity to add or remove a cosigner.

How does refinancing a car work? You’ll need to know this information for yourself so you can apply for the correct financing. The $1,500 can now be used for.

We’ve told you that refinancing a car loan means substituting your existing auto loan with a fresh one. Refinancing your rv can be done with minimal changes to your credit score if you follow some simple tips. Depending on your situation, auto refinancing could lower your interest rate, your monthly payment or change the duration of your loan.

Depending on your situation and credit profile, refinancing could save you money through a lower interest rate, a longer repayment period, or both. Refinancing a car loan involves taking on a new loan to pay off the balance of your existing car loan. How does refinancing a car loan work?

You give the new lender authority to pay off your existing loan. Refinancing your car means replacing your current auto loan with a new one. This allows you to reduce your monthly installments.

The new loan pays off your original loan, and you begin making monthly payments on the new loan. How does refinancing a car work? When does refinancing a car loan make sense?

You’ll pay all the same closing costs that you did when you took out the first loan, and this can add up to thousands of dollars upfront, depending on the size of your new loan. If done correctly, refinancing your car loan can potentially save you money. Request a loan payoff from your current lender.

Refinancing simply means that you pay off your current car loan with a new loan. This process can have varying outcomes for car owners. And remember, if you already have bad credit, you can still apply for a bad credit loan.

Your current car loan and title are transferred to a new lender and you will make your monthly car loan payments to this new lender. As such, your lienholder can repossess your car if you fail to honor your loan payments. Refinancing your car loan means simply switching to a different lender that may be able to offer you lower rates, fewer fees or easier repayment options to help you pay off your loan sooner.

How does refinancing a car loan work? At that rate, bert’s loan will have a monthly payment around $423 and his total interest cost will be more than $10,000 over the life of the loan. However, the savings you qualify for depends on many factors outside of your credit, including your vehicle and current loan.

Maybe it’s lower monthly payments that work better with your current financial situation. Just follow the following four steps: The application process for refinancing doesn't take much time, and many lenders can/may make determinations quickly.

Refinancing your car loan is replacing your current auto lender with another lender. Now you know that you can refinance your vehicle, but what you might not know is that we can help refinance more than just your primary car. Refinancing your car loan can have some or all of the following benefits:

With a lower interest rate, or with a longer loan term. There are several reasons for refinancing your car loan. Refinancing a car loan is the process of replacing your original auto loan with a new one.

You apply for a new loan and get approved. This was briefly touched on above, but if you’re thinking about refinancing an existing loan, it needs to make financial sense. All in all, the total cost of greta’s $20,000 vehicle will come out to $23,200, while the same vehicle will cost bert a total of $30,000, meaning bert’s bad credit has an effective price tag of nearly $7,000.

That much is obvious, but how does refinancing a car work. In fact, you can refinance anything with wheels! When you decide you want to refinance your car, you’ll be ready to move quickly.

Refinancing an auto loan means replacing your current car loan with a new one. When you decide to refinance an auto loan, there are two ways you can save money: Follow these simple steps to refinancing a car loan without any extra stress.

You can achieve this by either securing a lower interest rate, or adjusting the term of your loan, ideally both. You start paying the new auto loan company. Refinancing can make sense if it will lower your monthly payments by replacing a high interest rate with a lower one.

By refinancing your vehicle, you can extend the payment period of your vehicle loan. Refinancing often reduces your monthly payment and lowers the cost of your car over the life of your loan.

Lending Club Review Auto Business And Investment Loans

Find the Cheapest Loans Get a Cheap Loan Comparison Now

Auto Refinance LoansMay Be An Option For You Read our

New Excel Payment Schedule Template in 2020 (With images

How to Restore your Credit to Qualify for Mortgages, Car

Car title loans offer you a very flexible loan that works

A loan amortization schedule is commonly used with

Refinance Your Auto Loan (Our Top 6 Picks of 2020

What is an installment loan? How an installment loan works

When Can You Refinance Your Auto Loan? Car loans

Car Down Payment Calculator to Help You Decide How Much is

Should You Refinance or Use a Home Equity Loan

Suspended Medium Loans for bad credit, Car loans, Car

Auto Loan Calculator Loan calculator, Car loans, Car

You may be satisfied with the conditions of your car loan

Taking a used car loan to finance your vehicle? Wondering

Offers auto loans and refinance options for new and used

IDBI Bank offers car loans with attractive interest rates

Post a Comment for "How Does Refinancing A Vehicle Loan Work"